Calculate how much you need to save to reach a goal

The savings calculator for a target amount is ideal when you know exactly how much you want to save, whether it’s for a car, a dream vacation or a house.

How to Use the Savings Calculator?

To provide accurate results, the calculator requires a few essential inputs. These include:

- Target amount – The goal you want to achieve.

- Savings duration – How long you plan to save.

- Initial deposit – Any starting amount you want to contribute upfront.

You’ll also need to enter an expected rate of return, which will depend on where you choose to save or invest your money. For example:

- If you deposit the money into a savings account, the bank will provide the annual interest rate in your agreement.

- If you’re investing in stocks or bonds, the expected return won’t be guaranteed. In that case, it’s helpful to refer to historical data. While past performance doesn’t guarantee future results, it can give you a general idea.

Additionally, the calculator allows you to specify the frequency of contributions as well as the frequency of compounding. While annual compounding is the most common, it’s always good to verify these details.

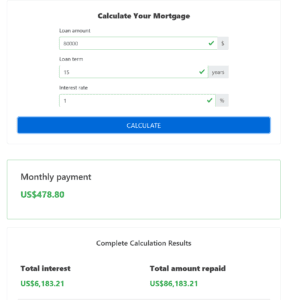

Once all the fields are filled out, the calculator will provide you with key insights, such as the required monthly contributions, the total amount you’ll deposit, and the interest earned. A detailed table will show how your savings will grow over time.

Building Wealth Through Saving

Wealth isn’t built overnight—it’s built through consistent saving. Many people don’t realize how transformative it can be to develop strong saving habits.

Here’s a simple perspective:

- If you save 10% of your income, you’ll have enough in just nine months to take a month off work.

- Saving 20% of your income reduces that time to four months.

- And if you live on 50% of your income and save the rest, you could work one month and take the next month off—or work for six months and enjoy the other half of the year without working.

Alternatively, by maintaining consistent saving habits, you could achieve bigger dreams like buying a home, taking a dream vacation, or getting that car you’ve always wanted.

While earning a higher income does make it easier to save, it’s not the only factor. Many people with high incomes fail to save simply because they don’t have the discipline or habits to set money aside. That’s why cultivating the habit of saving is essential, regardless of your income.

Importantly, saving doesn’t just mean stashing money in a bank account. It can also mean regularly investing in the stock market, bonds, or real estate.

Start Saving Now

The sooner you start saving, the sooner you’ll see the rewards. However, before choosing a savings or investment product, take the time to review the guidance offered by your national bank on selecting the best option for your financial needs.

The information in this article is for information purposes only. We are not responsible for the accuracy, reliability or completeness of the information or opinions contained on this website. You can find more information in our Legal Disclaimer.