Calculate how small, regular expenses add up

Cafe Latte with a friend? Ice cream on a nice sunny day? Some drinks after work? A small snack here and there? All these are the tiny things that make our days better. I completely agree and I myself indulge many of them. However, these tiny expenses are exactly the reason why you save so little if something at all.

What is the Latte Factor? And what is the goal?

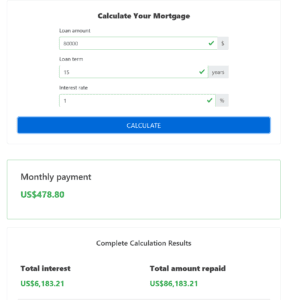

The goal of the Latte Factor is to emphasize that it is the regular, impulsive, tiny purchases that make the biggest hole in our personal finance. Use the Latte Factor calculator above and check how much you could save monthly or yearly if you managed to spend less on the tiny, unnecessary expenses, like for example Cafe Latte!

Small, unnecessary expenses are the source of all evil

Latte Factor promotes a very simple idea. The idea is that it is small daily expenses like coffee, bottled water, various subscriptions, and similar that make our dream of a better financial situation more and more distant. Latte Factor is trying to show us that if we managed to limit (or eliminate) our compulsive, and in many cases unnecessary, spending, our personal finances would improve rapidly.

A lot of people think that it is the big expenses that are problematic. That is not true. Big expenses are usually planned beforehand. They are not impulsive. When we want to buy a new car, fridge or TV, we usually plan it. We do research, make a saving plan, and then buy. On the other side, tiny expenses are spontaneous. They seem insignificant. We think “It is only $5”. But when we buy a coffee each day, bottled water 2-3 times a week. If we subscribe to Spotify, Netflix, HBO, Disney+. It adds up. In a year’s horizon, we talk about a big amount.

There is a false narrative in society that says that for one to become rich one has to have a high income. That is not true. There are plenty of people among those with a low, medium as well as high income that struggle with personal finance. Also, there are plenty of others that have a good personal economy and consider themselves if not rich, then at least middle class or comfortable with their savings.

So what is the difference? What is the key to a better personal finance? The answer is simple. Saving and spending habits under control.

Saving as a way to build wealth

Saving is what makes a difference. If one spends the whole salary, then it doesn’t matter how much one earns. One has to save (and eventually invest) to build wealth. To save, one has to change its spending habits. The equation is simple. Spend less, save more, and try to maximize your income. I am sure that many of those that struggle today could achieve a decent standard of living if they improved their spending habits

I am writing about limiting such purchases and not about complete elimination because I think that complete elimination is not sustainable in the long run. One needs to indulge himself from time to time. However, it is necessary not to overdo it and especially to always think about whether I will make a given expense or not at a given moment. In this way, one keeps an overview of one’s impulsive spending.

Improve your spending habits

The goal is not to eliminate spending. That will lead nowhere. We need to indulge from time to time. Therefore, I am talking about having control over our spending habits. By that, I mean to question each expenditure. Ask ourselves whether it brings us some long term added value, whether it brings us happiness.

Take, for example, coffee. Does the cup of coffee bring happiness? Sure it does. And if we take it together with our partner, friends, or colleagues, the amount of happiness increases. But do we have to have an expensive coffee from Starbucks for $5 or more? Won’t a cheaper (and maybe a better, less sugary) coffee from 7-Eleven do the same? Or a coffee from the coffee machine from the office? Or one made at home and enjoyed on the terrace or out in the park? I think that many times it does and even brings more happiness.

Another example can be all the subscription services. Do you have to subscribe to all of them at once? Won’t subscribing to Netflix for 1-2 months, then switching to HBO for 1-2 months, then to Disney+ (for example, in X-mass time) brings the same happiness? I think it will. And you will save a lot of money. Also, did you consider family subscriptions?

Try to apply similar critical thinking to each of your expenditures. Question each of them. Ask yourself: “Is it necessary? Will it bring me happiness or will it improve my life in some way in the long term? Will it bring some added value?” If you question each expenditure, your spending habit will improve and your savings too. And this is the Latte factor.

The information in this article is for information purposes only. We are not responsible for the accuracy, reliability or completeness of the information or opinions contained on this website. You can find more information in our Legal Disclaimer.