How inflation influences your money?

The value of money decreases over time. In 2005, you were able to buy many more goods or services for $500 than for the same $500 in 2020. $500 in 2005 was more valuable than $500 in 2020. The cause of the decline in the value of money is inflation. If inflation is positive (almost always), the price of money falls over time. If inflation is negative, that means if it is deflation, the value of money rises over time. However, deflation is a rare phenomenon that has occurred only a few times during the largest financial crises.

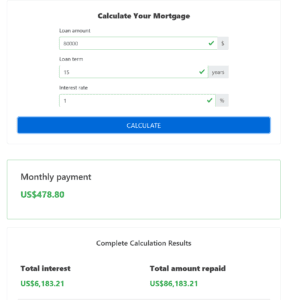

The inflation calculator (above) will help you calculate the future value of money based on the assumed annual inflation rate. Inflation should always be considered when a financial transaction does not happen right away, but takes place over a period of time, or sometime in the future. To include inflation into the calculation is critical, for example, when planning your retirement savings, when assessing the profitability of a mortgage, or when borrowing money from or to others.

Present Value

The present value is the value of money in the future expressed in current money. As I said above, the value of money today is higher than the value of money in the future.

Because the value of money changes over time, all financial calculations should be calculated with and compared to a constant value of money, that is, to the value of money at a particular date. Usually, “today” (the present) is used as the date of reference. Hence the name “present value”.

The present value is a gold standard when calculating and comparing investments.

The formula for the present value is as follows:

![]()

where:

![]() – present value

– present value

![]() – future value

– future value

![]() – an expected rate of return, eventually an expected inflation rate. Expressed in decimal

– an expected rate of return, eventually an expected inflation rate. Expressed in decimal

![]() – number of time periods, in our case years

– number of time periods, in our case years

Future Value

The future value tells us what amount of future money will correspond to the amount of money at present value after a certain period of time at given average inflation or rate of return. The future value is thus a function that is expressed by the following equation:

![]()

where:

![]() – future value

– future value

![]() – present value

– present value

![]() – an expected inflation rate, eventually an expected rate of return

– an expected inflation rate, eventually an expected rate of return

![]() – number of time periods, in our case years

– number of time periods, in our case years

Both present value and future value are functions of inflation (or rate of return) and time. Understand: inflation (or rate of return) and time directly affect the ratio of present and future value.

Examples

Let’s look at a few examples to better understand inflation/rate of return and current and future value.

Calculation of Retirement Savings

I Want To Get a Fixed, Monthly Amount for Retirement. How Much Do I Need To Save Each Month?

Retirement savings works differently in the U.S., Europe, as well as other parts of the world. It is impossible to make an example that will fit all retirement schemes in the world. Therefore, consider it literally “an example” and adjust it to your situation and the pension system in your country.

You think that a $1,000 a month extra to whatever pension agreement you have from the job (for example, 401k) or the state would be enough to have a decent life in retirement. Therefore, you decide to start saving for retirement so that after reaching retirement age, you will be able to pay $1,000 per month from your pension savings for the first ten years (the financial needs of pensioners decrease over time). With this in mind, however, it is crucial to keep in mind that $1,000 today has a different value than $1,000 in 20 or 30 years when you retire. That what the inflation calculator is for.

Let’s say you’re 35 and plan to retire at 65. So you have 30 years until retirement. It is very hard to predict what the average inflation rate will be during these 30 years. But let’s say it will be 2% on average. By entering these values into the inflation calculator, you will find that to be able to buy the same goods and services in 30 years that you can buy for $1,000 today, you will need $1,811. That’s a pretty big difference.

So you need to save enough to be able to pay $1,811 a month for ten years. But how much is it? To get the answer, we use a calculator to calculate the principal for the monthly annuity (the calculator is coming soon). For the case above, after entering the values of $1,811, 10 years, and the expected average income of 5% per year, we find that we need to save $170,743.53 in total, which should theoretically be enough to pay our monthly annuity for required, 10 years.

So you need to save enough to be able to pay $1,811 a month for ten years. But how much is it? To get the answer, we use a calculator to calculate the principal for the monthly annuity (the calculator is coming soon). For the case above, after entering the values of $1,811, 10 years, and the expected average income of 5% per year, we find that we need to save $170,743.53 in total, which should theoretically be enough to pay our monthly annuity for required ten years.

For our calculation to be complete, we still need to find out how much we have to save per month to be able to reach the mentioned amount. For this calculation, we will use the savings goal calculator (or also a calculator for saving with the target amount). The savings goal is, therefore, $170,744. We will keep the initial deposit at $0, and we will again choose 5% for the expected average annual return. The savings period is 30 years. After entering these values, we will find that we need to save less than $210 per month.

That was an example of a calculation when you want to achieve a certain fixed monthly annuity (in our case, a monthly payment to improve your overall pension) and how to find out how much you need to save per month to achieve it.

The information in this article is for information purposes only. We are not responsible for the accuracy, reliability or completeness of the information or opinions contained on this website. You can find more information in our Legal Disclaimer.